Banking as we knew it- clunky websites, endless forms, and outdated systems is disappearing. The financial sector is revolutionizing pixel by pixel, with smart fintech apps. But building one that’s secure, intuitive, and stands out? That’s where most stumble.

Most fintech apps fall short as they overpromise and underdeliver, ending up with buggy and barely secure platforms. Traditional development methods can’t keep up with today’s fast-paced, high-stakes financial environment.

According to Allied Market Research, the global fintech market is booming, set to surpass 500 billion dollars by 2030, with users demanding faster, smarter, and more secure financial solutions. This is why developing an application with scalable infrastructure matters now more than ever.

Let’s plunge into the world of fintech app development. This isn’t just about building an app; it’s about crafting secure, user-friendly, and innovative solutions that disrupt traditional financial services

Understanding the Fintech Landscape

Think of the fintech world as a bustling metropolis, constantly evolving with new skyscrapers of innovation popping up daily. To succeed in this fast-moving space, you need to understand the current landscape and where it’s heading.

What Exactly is a Fintech App? (Beyond Just “Finance on Your Phone”)

At its core, a fintech app leverages technology to enhance, automate, and streamline financial services. But it’s more than just putting a bank in your pocket. It’s about creating seamless, user-centric experiences that solve real financial pain points. A well-designed fintech app is not just a digital extension of traditional banking, but a complete reimagining of how people interact with their money.

Fintech apps address real-world financial problems with smarter, faster, and more user-friendly solutions. They remove the friction and automate tasks that require long processing times. Unlike legacy financial platforms, fintech apps prioritize user experience as they’re built to be intuitive, accessible, and personalized. For instance, PayPal’s initial interface and functionality lagged behind new players like Stripe or Square.

Whether it’s transferring money internationally, investing spare change, managing personal budgets, applying for loans, or even buying insurance, fintech apps make these services available anytime, anywhere, in just a few taps.

Fintech today leverages data and machine learning to tailor experiences to each user. This isn’t just about going digital, it’s about giving users control, transparency, and simplicity in how they manage their financial lives.

So yes, the destination is still financial management. But the journey, how users get there, is completely transformed. From clunky forms and waiting rooms to real-time insights and instant approvals, fintech apps are setting a new standard for what modern finance looks like.

The Diverse Ecosystem of Fintech App Development: From Wallets to Wealth Management

The fintech landscape is incredibly diverse. Based on your niche, you need to know the different categories of fintech apps to design a solution that hits the mark.

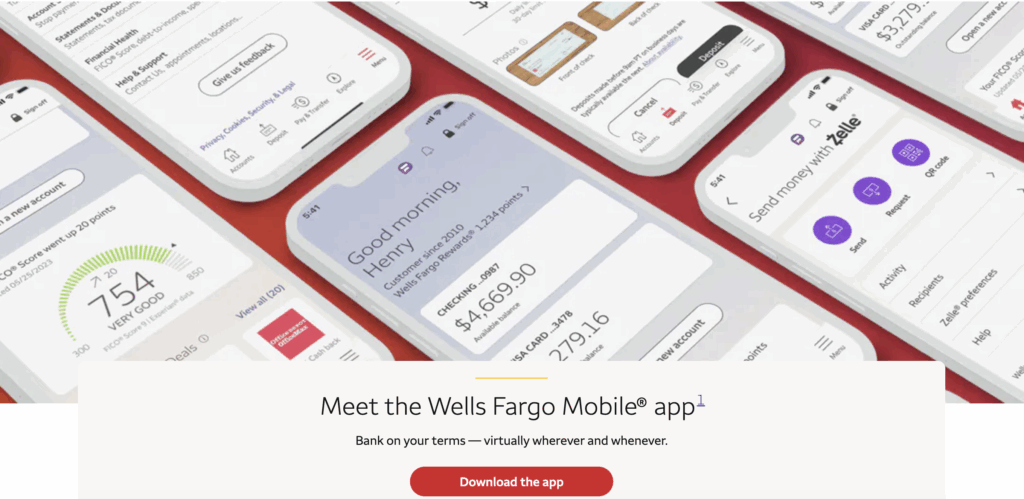

Mobile Banking Apps:

These are the digital extensions of traditional banks, allowing you to check balances, transfer funds, pay bills, and more, all from your smartphone. Think of them as your trusty financial sidekick, always accessible for your convenience.

For example: Chase Mobile, Wells Fargo Mobile.

Payment and Digital Wallet Apps:

Digital wallet apps have revolutionized how we pay, send, or receive money. They support contactless payments, QR code scanning, and even peer-to-peer transfers. They’re like the modern-day equivalent of a sleek, secure digital purse, widely used for e-commerce transactions.

For example: Google Pay, Cash App.

Investment and Trading Apps:

These apps democratize investing, giving individuals easy access to stock markets, crypto, and more. They’re built for investments, allowing everyone from seasoned traders to newbie investors to participate in the markets. Trading apps often have real-time market data and low to no commission fees.

Lending Apps:

Lending apps streamline the often-cumbersome process of borrowing money, offering faster approvals, transparent, and more accessible options. They often use alternative credit scoring methods. The goal is to connect borrowers with lenders efficiently.

For example: LendingClub, Tala

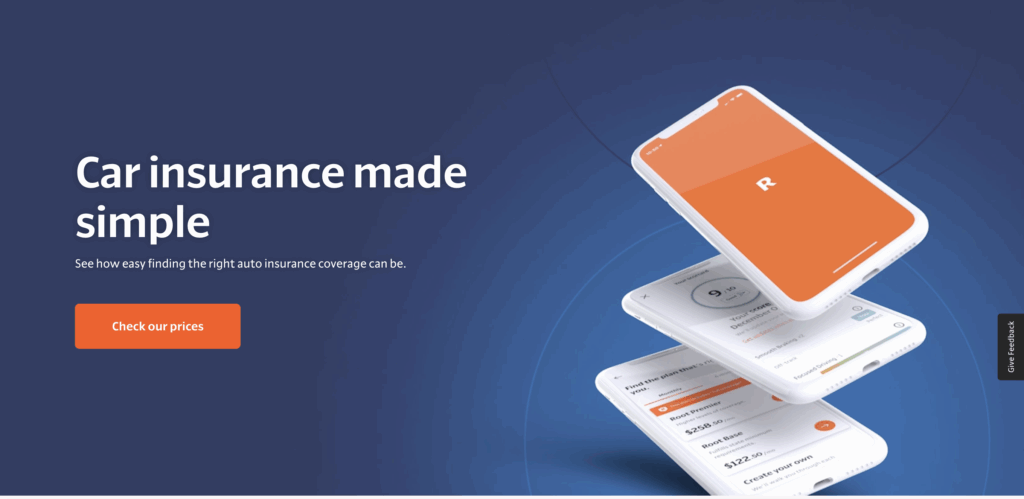

Insurance Apps (Insurtech):

Insurtech is shaping how insurance is purchased and managed. From personalized policies to managing claims processing, everything happens digitally, making the process quicker and more transparent. It’s like having a proactive insurance agent at your fingertips.

For example: Lemonade, Root Insurance

Budgeting and Personal Finance Apps:

It is designed to help users track expenses, set goals, and improve financial health, empowering users to take control of their finances. Consider them your financial coach, and often include features like bank syncing, savings goals, and smart alerts.

For example: Mint, YNAB (You Need a Budget)

Cryptocurrency Apps:

Crypto apps allow users to buy, sell, and manage digital currencies. Many also provide wallets, real-time charts, staking options, and educational resources. They’re like the gateway to the decentralized world of crypto.

For example: Coinbase, Trust Wallet

Neobanks:

These are 100% digital banks with no physical branches. They offer innovative features and a more user-friendly experience with lower fees, faster onboarding, and user-friendly experiences tailored for mobile-first users.

Regtech Apps:

Short for regulatory technology, these apps help financial institutions navigate the complex world of regulations and compliance. They automate tasks like KYC (Know Your Customer), anti-money laundering, and reporting, ensuring the financial system operates smoothly and securely.

Understanding this diverse landscape is crucial for identifying opportunities in the competitive environment for your fintech app development journey.

Navigating the Fintech App Development Process

Building a successful financial app isn’t a sprint; it’s a well-planned marathon. Here’s your step-by-step guide to crossing the finish line strong.

1. Idea Validation and Market Research

Before you even think about code, you need to ask yourself the problem you want to solve with your app and your target audience. Think of this stage as a treasure map, as you need to identify where the real gold (user demand) lies. Here’s what you need to do in this step:

- Identify a Pain Point: Identify the frustrations people currently experience with financial services, such as slow processes, high fees, lack of transparency, or clunky interfaces. Your app should be the elegant solution to this pain.

- Know Your Audience: Create detailed user personas of your target audience. Whether you’re targeting millennials, Gen Z, or small business owners, you need to have clarity as to which segment of the audience you want to target. Understanding their demographics, behaviors, and financial needs is paramount.

- Competitive Analysis: Identify other fintech apps that are out there in the market. This isn’t about copying; it’s about identifying gaps and opportunities to offer something better, something unique.

- Market Validation: Talk to potential users. Get feedback on your idea. Conduct surveys or focus groups. You should not ignore signs that your best idea might not resonate with the market.

2. Regulatory Compliance

When building a fintech app, ignoring regulations is like building a house on shaky ground – it might look good for a while, but it’s bound to crumble.

- Understand the Landscape: Depending on your target market and the type of financial services you offer, you’ll need to comply with various regulations. Think GDPR for data privacy, KYC (Know Your Customer) and AML (Anti-Money Laundering) for identity verification and preventing illicit activities, and specific financial regulations in different countries (e.g., PSD2 in Europe, CCPA in California).

- Seek Expert Advice: Don’t try to navigate this minefield alone. Consult with legal and compliance experts who specialize in the fintech industry. They’ll help you understand your obligations and ensure your app is built with compliance in mind from the outset.

- Build Compliance into Your Architecture: Security and compliance shouldn’t be afterthoughts. They need to be the very foundation of your app’s architecture and development process.

3. UI/UX Design: Creating a Symphony of Simplicity and Trust

Your app’s user interface (UI) is what users see and interact with. The user experience (UX) is how they feel while using it. In the finance sector, trust and ease of use are vital. If your app looks confusing or feels clunky, users will likely abandon it faster than you can say “blockchain”.

- Focus on Intuitive Navigation: Make it easy for users to find what they need. Use clear labeling, logical flows, and consistent design patterns. Think of it like designing a well-organized supermarket, everything should be easy to find.

- Build Trust Through Design: Financial apps handle sensitive information. Your design should exude security and trustworthiness. Use clear security indicators, professional aesthetics, and avoid anything that looks even remotely phishy.

- Prioritize Readability: Use clear typography, sufficient white space, and avoid overwhelming users with too much information at once. Emphasis on readability, no technical jargon, and clear formatting are your allies here.

- Mobile-First Approach: Design specifically for mobile devices, considering different screen sizes and touch interactions.

- Accessibility: Ensure your app is accessible to users with disabilities. This not only expands your potential user base but also demonstrates inclusivity.

- Usability Testing: Continuously test your designs with real users to identify pain points and areas for improvement. Don’t assume you know what your users want; involve them in your fintech app design process.

4. App Development: Choosing Your Weapons

This is where your vision starts to take tangible form. Choosing the right technologies and development approach is crucial for building a scalable, secure, and high-performing financial app.

- Platform Choice: The choice of platforms depends on your target audience. Developing for both iOS and Android platforms offers the widest reach but also increases the cost to develop a fintech app. You might consider starting with one and expanding later.

- Technology Stack: The combination of programming languages, frameworks, and tools you use. Your platform choice can further affect your tech stack to build a fintech app. For the front-end (what users see), popular choices include Swift (for iOS), Kotlin (for Android), and React Native or Flutter (for cross-platform development). For the back-end (the engine room), languages like Python, Java, and Node.js are common. Consider factors like scalability, security, and the availability of skilled developers.

- Security First: Security isn’t just a feature; it’s a fundamental requirement for any financial app. Implement robust encryption (both in transit and at rest), secure authentication methods (multi-factor, biometrics), and protect against common vulnerabilities like SQL injection and cross-site scripting. Regular security audits are non-negotiable.

- API Integrations: Your app will likely need to connect with various third-party services, such as payment gateways, banking APIs, and data providers. A secure and reliable API management platform and integration are crucial for functionality.

- Scalability: Growth plan. Your app should be able to handle an increasing number of users and transactions without performance degradation. Design your fintech infrastructure focusing on scalability. Cloud-based solutions are often a good choice for scalability.

5. Testing and Quality Assurance

Imagine a banking app that crashes every time you try to make a transfer. Not exactly confidence-inspiring, right? Rigorous testing is essential to identify and fix bugs, ensure security, and guarantee a smooth user experience.

- Different Types of Testing: Your fintech app needs to go through a variety of testing phases. For instance, Unit testing (testing individual components), integration testing (testing how different components work together), user acceptance testing (getting feedback from real users), and security testing (identifying vulnerabilities).

- Automation: Automate as much of your testing process as possible to improve efficiency and consistency.

- Continuous Integration and Continuous Deployment (CI/CD): Implementing CI/CD pipelines allows for frequent code updates and faster bug fixes, ensuring your app stays in top shape.

- Deploy Beta Version: Once your product is ready, launch beta versions to a limited user group before final product deployment. This helps to implement multiple feedback channels. Use in-app surveys, or trigger surveys after completed interactions to get Customer Effort Score (CES). This can help minimize future churn rate as it demonstrates your commitment to user-centered development.

6. Deployment of Your Fintech App

Once your app is polished and ready, it’s time to launch it on the app stores.

- App Store Optimization (ASO): Just like SEO for websites, ASO helps your app get discovered in the app stores. Optimize your app’s title, keywords, description, and screenshots.

- Launch Strategy: Plan your launch carefully. Consider a soft launch to a smaller audience for initial feedback before a wider release.

- Marketing and Promotion: Let the world know about your amazing fintech app. Utilize social media, content marketing, PR, and paid advertising to reach your target audience.

7. Maintenance and Updates

Launching is just the beginning. To keep your users engaged and your app competitive, ongoing maintenance and updates are crucial.

- Optimize performance: Fintech apps usually face peak traffic during payday or tax deadlines. To maintain performance, implement horizontal scaling to share loads, data sharding to divide data across platforms, and caching strategies to improve response time.

- Bug Fixes and Performance Improvements: Regularly monitor your app for bugs and performance issues and release updates to address them.

- Security Updates: Stay vigilant about security threats and release updates to patch any vulnerabilities.

- New Features and Enhancements: Continuously add new features and improve existing ones based on user feedback and market trends. Prioritize constantly evolving your app to meet the ever-changing needs of your users.

Cost of Fintech App Development

The cost to develop a fintech app is a question that keeps many aspiring entrepreneurs up at night. The truth is, there’s no one-size-fits-all answer. It depends on the size, location, materials, and the level of customization. However, we can break down the key factors:

- Complexity of Features: A basic budgeting app with simple transaction tracking will cost significantly less than a sophisticated trading platform with real-time data and algorithmic trading capabilities. In terms of building blocks, the more complex the structure, the more blocks and time you’ll need, increasing the cost of development.

- Platform (iOS, Android, or Both): Developing native apps for both iOS and Android will naturally double your development effort compared to focusing on a single platform initially. Cross-platform frameworks can sometimes offer a more cost-effective alternative, but they come with their own set of considerations.

- Design Complexity: A simple, clean design will be less expensive than a highly customized and visually intricate interface. Remember, while aesthetics are important, usability and trust are crucial in financial app development.

- Development Team Location and Size: Development rates vary significantly across the globe. Teams in North America and Western Europe typically have higher rates than those in other regions. The size of your team (developers, designers, testers, project managers) will also impact the overall cost. To save your development cost, consider opting for staff augmentation services.

- Security Requirements: Implementing robust security features, conducting thorough security audits, and ensuring compliance with regulations will add to the development cost. However, this is a non-negotiable investment in the world of finance. Many modern fintech apps also integrate AI-driven fraud detection systems that monitor user behavior in real time to flag suspicious activity, adding another essential layer of protection and complexity to the development process.

- Integration with Third-Party Services: Each API integration (e.g., payment gateways – Stripe, PayPal, banking APIs) adds complexity and therefore cost.

- Testing Effort: Thorough testing is crucial for a stable and secure app, and the more complex your app, the more extensive the testing will need to be.

Key Takeaway: Don’t just look for the cheapest option. Focus on finding a dedicated development team that understands the intricacies of fintech app development, prioritizes security, and can deliver a high-quality product. The long-term costs of a poorly built or insecure app often outweigh any initial savings.

Boost Financial Innovation with Custom App Development Service

Unless you have an in-house dream team of fintech experts, you’ll likely need to partner with a fintech app development company or hire freelance developers. Choosing the right partner is a critical decision that can significantly impact the success of your project.

The right team does more than just code; they understand regulations, design intuitive user flows, and build with security and encryption. Get guidance through the entire product lifecycle, from strategy and architecture to launch and post-launch support.

Whether you’re building a budgeting tool, a mobile wallet, or a full-fledged neobank, our team helps you turn complex financial ideas into intuitive digital experiences.

[…] Check out an article on Optimizing JavaScript Performance: Tips and Tricks. […]

[…] audience segments, enabling rapid experimentation with designs and features. You can utilize modern JavaScript frameworks for enhanced performance and […]

[…] serves as the backbone of the new architecture. It allows direct communication between JavaScript and native modules using a C++ layer, eliminating the need for the old […]